This report’s Dishonorable Mentions generally comprise singularly unsound court decisions, abusive practices, legislation or other actions that erode the fairness of a state’s civil justice system and are not otherwise detailed in other sections of the report.

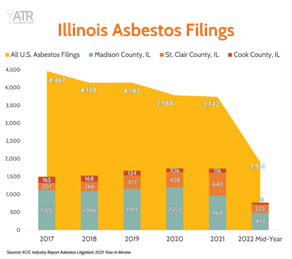

As asbestos claims continue to fall nationwide, the number of lawsuits filed in three Illinois counties, Cook, Madison and St. Clair, remain constant. The courts in these three counties host nearly half of the nation’s asbestos litigation. Plaintiffs flock to these county courthouses due to their plaintiff-friendly reputations, low evidentiary standards, and judges’ willingness to allow meritless claims to survive.

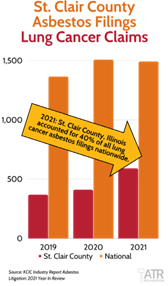

As asbestos claims continue to fall nationwide, the number of lawsuits filed in three Illinois counties, Cook, Madison and St. Clair, remain constant. The courts in these three counties host nearly half of the nation’s asbestos litigation. Plaintiffs flock to these county courthouses due to their plaintiff-friendly reputations, low evidentiary standards, and judges’ willingness to allow meritless claims to survive. St. Clair Country saw a greater than 50% increase in asbestos filings in 2021 mostly due to an influx of lung cancer claims.

St. Clair Country saw a greater than 50% increase in asbestos filings in 2021 mostly due to an influx of lung cancer claims.