NUCLEAR VERDICTS

Georgia is one of the most prolific producers of nuclear verdicts (awards of $10 million or more) nationwide. From January 1, 2018 through April 10, 2023, 39 nuclear verdicts in personal injury and wrongful death cases were reported, with 12 awarded in 2022 alone. Included in the 2022 verdicts was the previously mentioned eye-popping $1.7 billion punitive damages award out of Gwinnett County. Fulton, DeKalb and Gwinnett Counties produced 41% of the state’s nuclear verdicts during this time.

Georgia is one of the most prolific producers of nuclear verdicts (awards of $10 million or more) nationwide. From January 1, 2018 through April 10, 2023, 39 nuclear verdicts in personal injury and wrongful death cases were reported, with 12 awarded in 2022 alone. Included in the 2022 verdicts was the previously mentioned eye-popping $1.7 billion punitive damages award out of Gwinnett County. Fulton, DeKalb and Gwinnett Counties produced 41% of the state’s nuclear verdicts during this time.

In June 2023, a Fulton County jury awarded $32.5 million to the parents of a 21-year-old college student who was killed in a single-vehicle accident when he struck an ornamental planter off the side of the road, possibly to avoid either an animal that had entered the road or another vehicle. The City of Milton was found to have maintained a “dangerous public nuisance” by leaving the planter in place. The City requested a new trial, arguing that it had no liability because the planter was over 6 feet from the road – not in the right-of-way – and had been located there for decades without incident. The trial court denied the City’s motion and upheld the nuclear verdict. Ultimately, it will be the taxpayers that foot this bill.

In another case out of Cobb County, plaintiffs’ lawyers lamented that their near-record setting $80 million verdict in a tragic auto accident case was too low and that they were wrongly deprived of an additional $30 million in attorneys’ fees due to “stubborn litigiousness” by defendants. The jury disagreed; however, the lawyers plan to appeal.

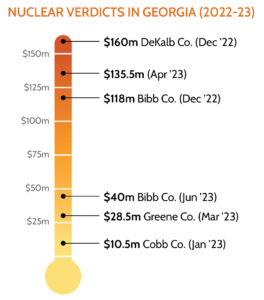

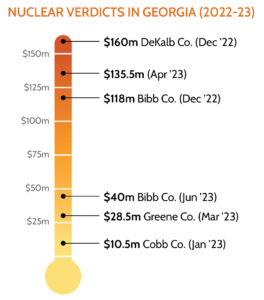

Other recent nuclear verdicts in Georgia courts includes:

December 2022: $118 million verdict (including $90 million in punitive damages) in a premises liability case in Bibb County

December 2022: $118 million verdict (including $90 million in punitive damages) in a premises liability case in Bibb County- December 2022: $160 million verdict in a premises liability case in DeKalb County

- January 2023: $10.5 million verdict in a medical liability case in Cobb County

- March 2023: $28.5 million verdict (including $6.5 million in attorneys’ fees and costs) in a premises liability case in Greene County

- April 2023: $135.5 million verdict (including $125 million in punitive damages) in a lawsuit against the owners and developers of a solar farm brought by neighboring property owners in the federal district court in Columbus. (On October 23, the judge issued a remittitur order that decreased the award to $5 million. The plaintiffs asked the judge to reconsider and filed an appeal)

- June 2023: $40 million verdict in a medical liability case in Bibb County

The dramatic rise in nuclear verdicts can be attributed to several factors, including the courts allowing the use of “anchoring” by plaintiffs’ lawyers. Anchoring is a tactic that lawyers use to place an extremely high amount into jurors’ minds to start as a base dollar amount for a pain and suffering award. While some courts prevent or limit this tactic, Georgia is one of a few that has a specific state statute allowing the practice.

The trucking industry has been a primary target of runaway verdicts, as has been well chronicled by recent Judicial Hellholes® reports. The nuclear verdicts against the trucking industry not only affect the companies named in those lawsuits, but the industry itself. According to a study by the American Transportation Research Institute (ATRI), the average auto liability premium has increased significantly for fleets of all sizes. With the average size of verdicts in excess of $1 million increasing from $2,305,736 to $22,288,000 nationwide between 2010 and 2018, insurance companies are charging more to cover these excessive litigation risks. These rising insurance premiums often hit small businesses the hardest and have driven many out of business.

Businesses are aware of Georgia courts’ propensity to award nuclear verdicts, and as a result, feel great pressure to settle prior to trial. In April, a defendant “accused of knowingly manufacturing a defective recreational vehicle” settled for $105 million, the largest pre-trial settlement in Georgia history.

Automakers in Crosshairs Thanks to Archaic Law

Under what’s known as the “seatbelt gag rule,” lawyers defending a product liability claim in Georgia cannot inform the jury that someone hurt in an auto accident was not wearing – or was misusing – a seatbelt.

Enacted by the Georgia legislature in 1988, critics of the statute argue that the policy behind the seatbelt gag rule has long ended. At the time of enactment, people questioned the effectiveness of seat- belts in preventing injuries. Some legislators believed that air bags were sufficient and seatbelt use was not widespread. Since then, forty-nine states have mandated the use of safety belts and numerous studies have proven the protection that modern seatbelts provide. With clear evidence that seatbelt usage is crucial to both a driver’s and a passenger’s safety, many states are discarding the seatbelt gag rule as an anachronistic law that “may have been appropriate in its time,” but has become outdated by further studies. Instead, these states allow juries to consider seatbelt use when allocating fault or determining the cause of an injury. Further, Georgia is a primary enforcement state, which requires seat belt usage or one can be given a citation.

Unfortunately, in 2022, the Georgia Supreme Court passed on an opportunity to constrain the state’s gag rule; however, the justices did leave the door open to a future change. The Georgia Legislature has had opportunities to eliminate the rule the past several years but has chosen not to move the legislation.

Update on Record $1.7 Billion Verdict

As mentioned earlier, in August 2022, a Georgia jury returned a $1.7 billion punitive damage verdict against Ford, finding that the company sold millions of “Super Duty” models with defectively weak roofs. This astronomical verdict helped propel Georgia atop last year’s Judicial Hellholes® list. The case was riddled with ethically questionable events and severely biased court orders, all of which were outlined last year. Additionally, Ford was prohibited from informing the jury that the plaintiffs were improperly wearing their seatbelts during a rollover crash.

Following the verdict, Ford promptly filed post-trial motions for a new damages trial and judgment notwithstanding the verdict. In September 2023, Judge Joseph C. Iannazone rejected Ford’s motions, finding that there was sufficient clear and convincing evidence for a jury to conclude that Ford was liable for punitive damages.

While Ford had argued that the excessive verdict was a product of “trial by sanctions” on account of a biased sanctions order that tainted the jury’s damage calculations, Judge Iannazone decided that his order did nothing of the sort. He also outright rejected Ford’s argument that the verdict was unconstitutionally excessive despite blowing past guideposts laid out by the U.S. Supreme Court. Even after acknowledging that the punitive damage award was “quite high,” he merely pointed out that the state’s cap on punitive damages does not apply to product liability cases. As a whole, Judge Iannazone decided that Ford had not proven that the jury verdict was “manifestly the result of prejudice, or bias, or corrupt motive,” or that it contravened the “principles of justice and equity.”

The court’s refusal to reduce the astronomical punitive damages award is particularly troublesome because this verdict practically tripled the prior record in Georgia for largest punitive damages verdict. For reference, the same plaintiff’s lawyer obtained a $150 million verdict against Chrysler back in 2014 in a small county in South Georgia – the trial judge in that case reduced the verdict all the way down to $40 million.

The saga will continue as Ford expressed that it will “seek a deserved new trial from the Georgia Court of Appeals.”

Good News

On March 15, 2023, the Georgia Supreme Court upheld the constitutionality of the state’s $250,000 cap on punitive damages in non-product liability cases in Taylor v. Devereux Foundation, Inc.

On March 15, 2023, the Georgia Supreme Court upheld the constitutionality of the state’s $250,000 cap on punitive damages in non-product liability cases in Taylor v. Devereux Foundation, Inc.

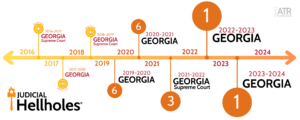

Georgia vaulted to the top of the Judicial Hellholes® report in 2022 thanks in large part to a massive $1.7 billion punitive damages award in a product liability case in Gwinnett County that was riddled with ethically questionable events and severely biased court orders.

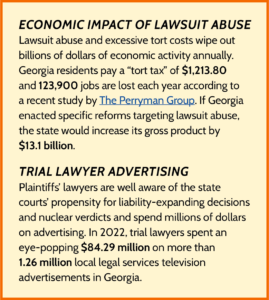

Georgia vaulted to the top of the Judicial Hellholes® report in 2022 thanks in large part to a massive $1.7 billion punitive damages award in a product liability case in Gwinnett County that was riddled with ethically questionable events and severely biased court orders. In addition, Georgia continues to embrace an archaic seatbelt gag rule that precludes a jury from hearing evidence about whether an occupant wore a seatbelt at the time of a crash, and third-party litigation financing provides the resources to drive the litigation machine. Both lawyers and lenders profit off the litigation, as unregulated cash-for-lawsuit companies offer plaintiffs loans at excessive rates, then take a substantial share of their awards.

In addition, Georgia continues to embrace an archaic seatbelt gag rule that precludes a jury from hearing evidence about whether an occupant wore a seatbelt at the time of a crash, and third-party litigation financing provides the resources to drive the litigation machine. Both lawyers and lenders profit off the litigation, as unregulated cash-for-lawsuit companies offer plaintiffs loans at excessive rates, then take a substantial share of their awards.

This year, the United States Supreme Court missed its opportunity to rein in litigation tourism and prevent plaintiffs’ lawyers from filing lawsuits in plaintiff-friendly courts that have no direct tie to a claim. In

This year, the United States Supreme Court missed its opportunity to rein in litigation tourism and prevent plaintiffs’ lawyers from filing lawsuits in plaintiff-friendly courts that have no direct tie to a claim. In  Georgia is one of the most prolific producers of nuclear verdicts (awards of $10 million or more) nationwide. From January 1, 2018 through April 10, 2023,

Georgia is one of the most prolific producers of nuclear verdicts (awards of $10 million or more) nationwide. From January 1, 2018 through April 10, 2023,  December 2022:

December 2022:  On March 15, 2023, the Georgia Supreme Court upheld the constitutionality of the state’s $250,000 cap on punitive damages in non-product liability cases in

On March 15, 2023, the Georgia Supreme Court upheld the constitutionality of the state’s $250,000 cap on punitive damages in non-product liability cases in  damages to plaintiffs, driving up awards and providing a windfall to plaintiffs and their attorneys. “Phantom damages” occur when courts calculate a plaintiff’s medical expenses using the amount a patient was billed for a medical service (chargemaster rate) instead of the amount the patient, their insurer, Medicare, Medicaid, or workers’ compensation actually paid, and the healthcare provided accepted, for treatment. For example, a hospital may bill $20,000 for an emergency room visit, while the amount the hospital actually receives after adjustments may be $8,000. The $12,000 difference is not owed or ever paid for the treatment – that is the amount of phantom damages.

damages to plaintiffs, driving up awards and providing a windfall to plaintiffs and their attorneys. “Phantom damages” occur when courts calculate a plaintiff’s medical expenses using the amount a patient was billed for a medical service (chargemaster rate) instead of the amount the patient, their insurer, Medicare, Medicaid, or workers’ compensation actually paid, and the healthcare provided accepted, for treatment. For example, a hospital may bill $20,000 for an emergency room visit, while the amount the hospital actually receives after adjustments may be $8,000. The $12,000 difference is not owed or ever paid for the treatment – that is the amount of phantom damages. eye-popping nuclear verdicts in Georgia, particularly law- suits blaming businesses for the criminal conduct of others on or near their property.

eye-popping nuclear verdicts in Georgia, particularly law- suits blaming businesses for the criminal conduct of others on or near their property. liability-expanding decision that, if not overturned, will drastically expand product liability for manufacturers. The plaintiff sued L’Oreal, alleging that its hair relaxer products caused her to develop uterine fibroids. As discussed earlier,

liability-expanding decision that, if not overturned, will drastically expand product liability for manufacturers. The plaintiff sued L’Oreal, alleging that its hair relaxer products caused her to develop uterine fibroids. As discussed earlier,  Companies that provide loans to plaintiffs in personal injury suits in exchange for a percentage of their awards are permitted to charge extremely high interest rates despite Georgia’s usury law.

Companies that provide loans to plaintiffs in personal injury suits in exchange for a percentage of their awards are permitted to charge extremely high interest rates despite Georgia’s usury law. Supreme Court ruled in

Supreme Court ruled in